SecuFlows -

your choice for compliant automation.

Model, automate and document data-driven processes.

Complete security

Flexibility and control for your workflows thanks to the native cloud platform – combined with the highest data sovereignty for automation in on-premise operations.

+500 Integrations

Seamless integration into your existing systems, as well as versatile and flexible scaling options.

Compliance focus

Comprehensive transparency across the process landscape, its processes and versions.

Efficiency made easy. Processes and workflows perfectly coordinated.

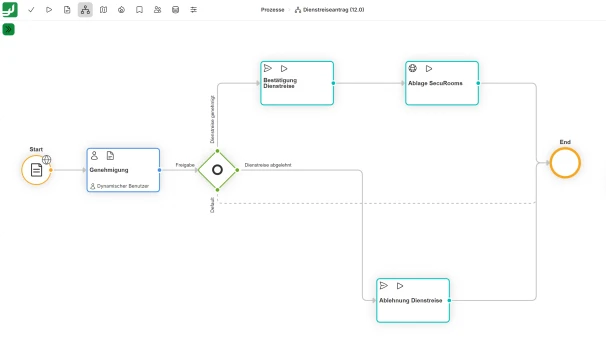

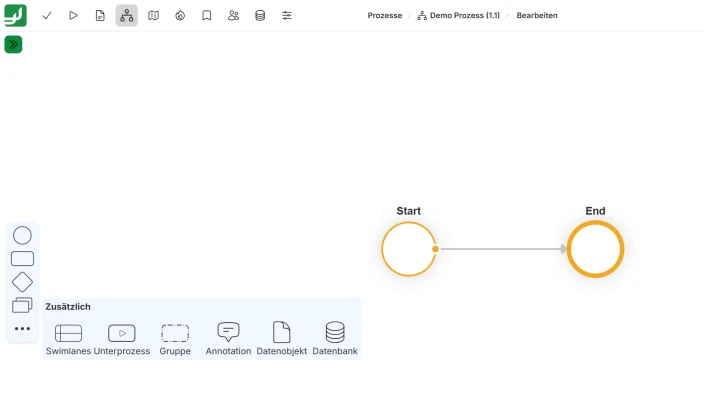

Graphical workflow builder

Map processes and their sequences with a mouse click according to the BPMN 2.0 standard. Then you can automate the documented process – simply, efficiently and securely.

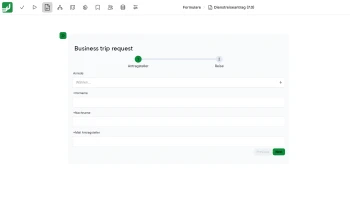

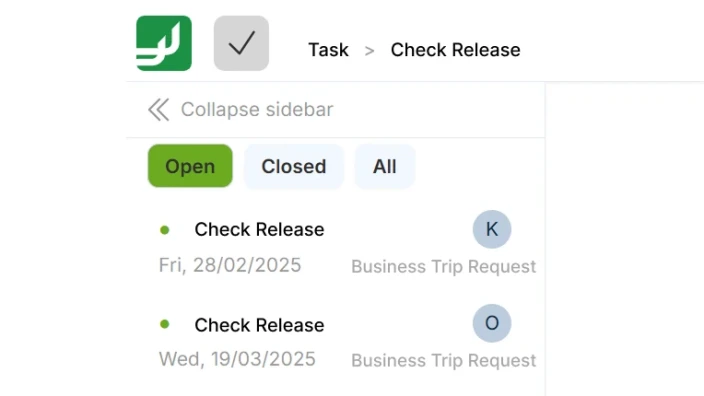

Human interaction

Involve human users in automation processes: Documents and files are created automatically according to your specifications. A specialist then takes over the review and approval before the automated process is restarted with a mouse click.

Security and compliance

Comprehensive functions and operating options ensure optimal protection of your data.

End-to-end encryption

Version management for processes

Audit trailCloud, on-premise or hybrid operation

Structure and design

Easy-to-use solution to model and automate your workflows and processes.

Graphical process modelling (BPMN 2.0)

Workflow-supported task management

Form builder

Reusable templates

Visual Process map

Connectivity

Use the full potential by connecting the FTAPI platform to your system landscape.

Seamless integration with 500+ systems

REST API for the use of other FTAPI products

Interactive processes

Curious?

Get personal advice.

One solution, many applications. This is how FTAPI SecuFlows are used.

Automated sending of patient data and findings

Ensure reliable and secure transmission of patient data for doctors and private individuals.

Automatically create and send payroll statements

An efficiency boost for your accounting: after successful setup via FTAPI, the creation of individual documents for employees and their sending is completely automated.

Transmit machine data directly to the service technician

In an emergency, things have to happen quickly and information should be made available in a simple but secure manner. With SecuFlows, we connect your systems with your employees.

Transmission of the electronic patient record (eAU)

Connect doctors and health insurance companies quickly and easily with SecuFlows, ensuring that all relevant data are stored securely in the system.

Process invoices and provide them to accounting

Manually scanning incoming invoices is a thing of the past: With SecuFlows, documents can be imported and processed directly upon submission.

Real-time synchronisation along supply chain systems

Make large project data available to the entire supply chain in real time, securely and in compliance.

Frequently asked questions.

Any procedure or business process that requires interaction with people and/or between systems and is regularly recurring as a routine is predestined for automation.

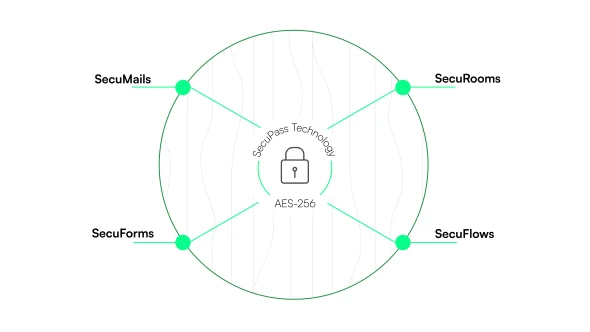

There are almost no limits to your imagination: In principle, all digital data, provided they are accessible via an interface in the source systems, can be made usable and processed using an automated workflow. Interfaces such as file systems, REST API, FTP but also FTAPI products such as SecuForms, SecuTransfer or SecuRooms can be used.

Our Technical Implementation Team will work with you to identify workflows that you can automate effectively and scalably.

Examples of automated workflows

Automated customer/citizen communication

Automated payroll accounting

Automated master data update

Automated application

Automated data synchronisation

Automated (coronavirus)-results query

Automated credit check

Automated transmission of test results and scan data

And what should not be automated:

Direct interaction with people

Decisions that affect people and require emotional understanding

Non-recurring themes

Topics that require creative solutions.

If possible, we connect a system with its specific interface (e.g. FTP, SQL, SMTP, IMAP). Data can also be read and processed from Excel or CSV files as well as from internal file systems. If these options are not available, the REST API is an alternative. Our Technical Implementation Team will be happy to discuss your requirements with you and has the right solution ready.

If you already have a specific process or business process in mind that you want to automate, we will discuss the technical requirements and the implementation process with you.

If you don’t have a use case in mind yet, we would be happy to work with you to identify individual workflows for your company in a workshop. We develop specific approaches based on your system landscape, internal structures and technical indicators.

We offer an increasing number of business processes in a quasi-standardised manner. This means that only a quick check of your specific requirements (third-party systems, interfaces, type and provision of data) is necessary and our team can then immediately begin implementation. The deployment of such automated workflows is usually possible within a few days.

Our promise: On average, implementation takes only a few hours or single days. Your data are secure and will be treated confidentially. No lengthy projects or code are necessary.

The automation client runs locally on your premises. The installation is done as a service under Windows or Linux. The hardware requirements depend on the business process that is to be automated. As a rule, servers with 4 cores and 8-12 GB RAM are sufficiently equipped.

If you are interested in implementing a SecuFlow, our Technical Implementation Team will discuss the specific requirements with you and conduct a short system check.

The configuration of the individual SecuFlows can also be carried out by yourself with a little know-how and the appropriate instructions. However, to ensure error-free functionality and smooth operation, we recommend that you have the implementation and configuration carried out by our experts. On average, this only takes a few hours or a few days.

Find out more.

Use Case

Digital payroll management with FTAPI.

Save time and money by automating the electronic delivery of payroll statements.

Blog

5 tips for digital invoice processing.

By digitising and automating your incoming invoices, you can drastically reduce processing times.

Product

A platform for your secure data exchange.

Emails, data rooms, automation - discover how you can securely exchange your data with FTAPI.

Success story

Retire paper payslips.

Equans Switzerland successfully implements the digitalisation of monthly payroll management with FTAPI.